Kenyans will continue to bear more cost of funding government through taxation after the proposed finance bill 2020 was passed into law. income tax allowable expenses have been reduced, various supplies that were exempt from VAT are now taxable and incomes that were exempt have now become taxable.

Today we will look at various expenses that were allowable under section 15 of the income tax act that will no longer be allowable.

- Entrance fee or annual subscription paid during that year of income to trade associations.

- Capital expenditure on legal cost and other incidental expenses relating to authorization and issue of shares, debentures, and similar securities to the public.

- Capital expenditure on legal cost and other incidental expenses for the purpose of listing on any securities exchange operating in Kenya without raising additional capital.

- Capital expenditure incurred on rating for the purpose of listing on any securities exchange.

- Club subscriptions paid by the employer on behalf of the employee.

- Expenditure of a capital nature incurred on social infrastructure.

The following incomes were exempt, they will now be taxable.

- income of homeownership savings plan.

- income of NSSF.

- Monthly Annuity or pension granted to a person over 65 years old.

- Employment from employment paid in the form of bonuses, overtime, and retirement benefits to employees whose taxable employment income before bonuses and overtime allowances does not exceed the lowest tax band.

“Monthly Annuity or pension granted to a person over 65 years old.” should the government be charging retirees, especially those over 65 yrs taxes having spent their entire work life paying taxes and build the country. Those in charge of drafting finance bills should re-look this in the coming financial years.

Published By

Senior Tax Analyst/Advisor

William Kuhunya

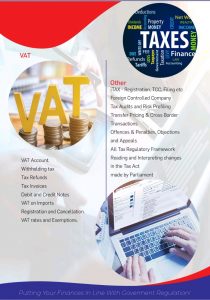

There will be more tax burden for Kenyans after finance bill 2020 was passed in parliament. The bill proposes several changes to the tax act. We shall discuss the changes that have been made to the income tax act, vat act of 2013, and excise act of 2015 in detail in due course. The introduction of Minimum Tax, TOT, DST, lowering the tax bracket for income tax, exemptions in the income tax will now be taxable, exemptions in the VAT act of 2013 will now be taxable and some of the ZERO RATED supplies will be subject to a higher tax rate. This means that Kenyans will have to dig deeper in their pockets to sustain the taxes imposed.

There will be more tax burden for Kenyans after finance bill 2020 was passed in parliament. The bill proposes several changes to the tax act. We shall discuss the changes that have been made to the income tax act, vat act of 2013, and excise act of 2015 in detail in due course. The introduction of Minimum Tax, TOT, DST, lowering the tax bracket for income tax, exemptions in the income tax will now be taxable, exemptions in the VAT act of 2013 will now be taxable and some of the ZERO RATED supplies will be subject to a higher tax rate. This means that Kenyans will have to dig deeper in their pockets to sustain the taxes imposed.

In case of any questions and clarifications call us or visit our offices. Don’t get caught unawares, failure to file taxes collectly and on time attracts a penalty.

In tax research services, we will assist you with deep 7 integrated tax research for general or specific tax issues that can affect the value of your business. Tax research will be dealing with not only because one has to follow tax studies in accounting, finance, economics, and law but also because different disciplines have different perspective towards taxes. For example, economists generally focus on tax compliance and tax incidence (such as who bears greater tax burden between consumers and producers as market forces take effect), lawyers will be greatly concerned with tax litigation and dispute resolutions and interpretation of the tax act, accountants with be concerned with how taxes affect the books of account and the effect on net margin, investors and entrepreneurs will be concerned on how taxes affect their capital investments and weighing their investment options based on taxes in different portfolios, scholars will focus on all tax changes in the curriculum. In finance, taxes are viewed as a markets imperfection, this view leads to studies on whether taxes affect firm value such as whether taxes affect firm expected returns, firm financial policy decisions (e.g whether taxes affect a firm’s use of leverage and hedging of funds) and the role of tax considerations in portfolio allocation.

As they say, death and taxes are the only certainties in this world. As is required by law all individuals and business are supposed to declare their incomes, file a return and submit that return to Kenya Revenue Authority. All businesses whether they make a profit or a loss are required to pay taxes. Tax laws change all the time, mostly annually through finance bills discussed and passed in parliament. Tax laws can be difficult to read and interpret and failure to understand them correctly can harm your finances, as you may face endless penalties, interest on penalties, time wasted on clearance and business loss for lack of full compliance.

All tax issues are surmountable, it just requires understanding. Pledge tax will assist you to discuss and give you a clear explanation related to tax compliance and regulation in general or a specific issue. The services of tax advisory are essential in order to align your finances in line with government regulation, minimize tax liability through tax planning and compliance and avoiding stiff penalties. At pledge we shall also be proactive in our approach to all our clients, reaching out to inform on any changes on the tax regulatory framework.

We are here to formulate solutions and making recommendations to all your tax problems.