KRA is implementing a Tax Invoice Management System to achieve validations and authentications of tax invoices at trader tills before generation of invoice along with their real-time or near real-time transmission. TIMS will enable KRA to make enhancements to iTax so as to increase its efficiency and effectiveness in tax administration through simplification of its user’s interaction.

This is accomplished by the use of a Control Unit connected or integrated into existing trader systems. The Control Unit will perform the functions of tax invoices validation, encryption, signing, transmission, and storage.

At pledge we will assist you set up Control Units with the following features as required by KRA:

- Invoice Validations as per the required validations: a. HS Code & VAT Rate Validations b. Invoice Sequence Validations c. PIN of the user of the Control Unit d. Time and date of the tax invoice e. Tax invoice serial number f. Buyer’s PIN g. Invoice Type (Original/Duplicate) h. Payment Mode (Cash, Debit Card, Credit Card, Pre-paid Card, Mobile Money, EFT, RTGS, Credit Note) i. Tax invoice total gross amount j. Tax invoice total tax amount k. Tax invoice total net amount l. Brief description of goods or services m. Quantity n. Unit of measure o. Tax Rate charged p. Control Unit serial number

- Encrypted Storage of a. TIMS Server Issued RSA Key and “PKI Ready”. b. Invoice Data. c. Control Unit Details E.g. Serial Number, Owner PIN

- Support for Offline Extraction of Encrypted Invoice data

- Support for Upgrades or update over the air including; a. Communication Protocol b. HS Code c. VAT Rate

- Internet Capable (Wireless, Ethernet, GSM)

- At least 24hr Power Backup on continuous usage for portables

- Control Unit should be serviceable

- “Display screen/Ethernet port can fail which can be a minimal cost replacement VS replacing the whole unit”

- Date & Time zone Synchronization with TIMS server

- Control Unit API & Technical Documentation (Mandatory). a. This will be needed for Control Units used for Invoicing Systems/POS systems where ERP developer requires to integrate with the Control Unit. b. Test API for Security flaws/gaps/ or

- User Access Control based on ID & password

- 100% Support for the TIMS Communication Protocol for communications with TIMS Server.

- Generate a QR Code for each invoice corresponding to the value of the Control unit invoice number.

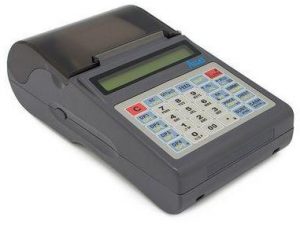

After setting up control units, the taxpayer will now secure ETRs or POS machines, at Pledge we will assist you with:

- Etrs and POS machines that have been configured to KRA specific requirements

- Most modern ETRS and POS machines

- Plug and play

- Train Staff on usage and application